FHA Home mortgage refinance loan Rules For new Borrowers

Intro So you can FHA Re-finance Funds

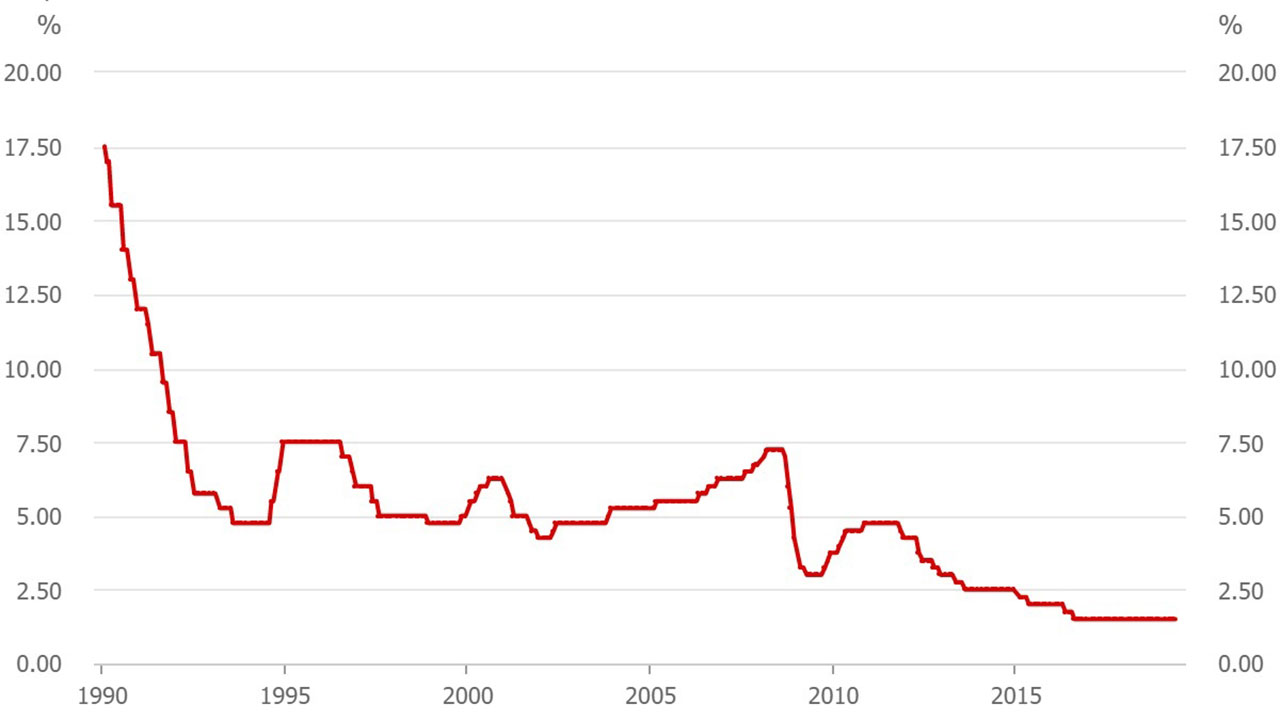

The fresh new Fed established a substantial speed cut-in 2024. One step features even more home owners contemplating the home mortgage refinance loan solutions and just how they are able to take advantage of possibly all the way down cost so you’re able to been. Refinancing assists specific borrowers spend less from inside the attract payments across the longterm. Additionally, it may, according to issues, help you get for the a reduced payment per month. After cost keeps fallen off to the right profile (for the majority of individuals) this type of solutions attract more sensible than just these are generally throughout the prior 2-3 years. Refinancing may also produce money back towards debtor just after the original loan might have been paid back and also the associated closing can cost you cared for. Its not all refinance mortgage now offers which, but FHA mortgage apps do were dollars-away solutions. If you want to refinance | far more.

You desire A keen FHA Refinance mortgage?

What exactly do you must know on FHA re-finance money? If you’re considering the choices and aren’t sure on the particular areas of the brand new FHA re-finance process, you will probably find certain answers to the questions you have below. FHA Home mortgage refinance loan FICO Score Standards FHA refinance finance normally require borrowing from the bank monitors and you may appraisals. There clearly was you to exception. There’s no FHA dependence on either when you find yourself implementing to have a keen FHA Streamline Home mortgage refinance loan. If you need to refinance however, care about your ability so you’re able to qualify for an enthusiastic FHA mortgage on account of credit affairs or other troubles? Get in touch with the latest FHA actually within 1-800 Telephone call FHA. Consult an advice to a community, HUD-accepted houses specialist who can help you with believed, budgeting, or any other important borrowing from the bank app affairs before one get otherwise | way more.

FHA Refinance Alternatives: No cash Out

FHA no money-out refinance selection may help first-day home buyers and you may knowledgeable homeowners alike. If you would like speak about your options to reduce rates of interest, shorten financing identity, or change to a predetermined-rate home loan, think about the choices discussed lower than. FHA Zero-Cash-Out Refinancing The fresh FHA zero-cash-out refinancing choice is best when you want to change the terms of your existing loan without getting dollars on closure. Refinancing towards the a fixed-rate, no-cash-away FHA loan is appropriate for most whenever interest levels are at the or below the pricing new debtor initially eligible to. Refinancing toward a fixed-rate loan off a variable-rates financial produces to possess a foreseeable loan, even when the rates is not as competitive as you you will for example. With a speed that will not change or does not transform once more | more.

An FHA refinance replaces your existing mortgage with a brand new you to. Frequently it’s always receive that loan with an increase of positive terminology otherwise get cash-out at closure big date but an enthusiastic FHA refi loan is completed to get off a conventional mortgage or a variable-price home loan. Consumers can be motivated to refinance discover a lowered attract rate, to reduce their mortgage https://paydayloanalabama.com/berlin/ label, otherwise tap into their property guarantee. The new FHA now offers several refinance software designed to different need. Which one suits you? FHA Rehabilitation Refinancing The brand new FHA 203(k) rehab refinance mortgage program enables you to acquire most money to have house home improvements otherwise solutions. This can help should you want to refinance and you can change your house at exactly the same time. You might refinance a normal loan otherwise a preexisting FHA | much more.

FHA Re-finance Choices for 2024

Of numerous anticipate home loan prices to start shedding into the 2024. Certain prospective FHA financing individuals wish to know what kinds of refinance solutions anticipate all of them given that housing marketplace recovery gets underway, but not reduced. We talk about a few of the alternatives less than. FHA Refinance loan Alternatives You may have multiple choices when it comes to help you FHA solitary-home financing re-finance selection. It are FHA cash-aside refinancing, FHA streamlines refinance fund, no-cash-away FHA refinances financing. You might refinance an existing property that have an FHA 203(k) rehabilitation loan one lets you re-finance and you can reline Refinance mortgage Solution During the early 2024 Real estate loan rates of interest are too large during the press time to contemplate using an enthusiastic FHA streamline refinance option. FHA streamline refi financing is actually for those who | a great deal more.

No Comments